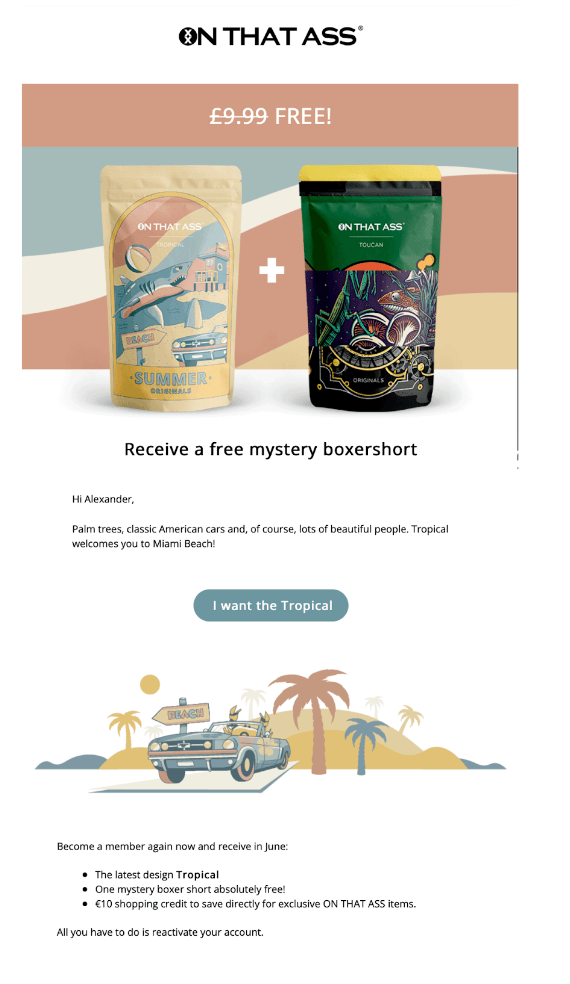

In Europe there’s a boxer short subscription ecommerce store called ON THAT ASS (yes, really). Let’s imagine you had a subscription with them for about nine months a couple of years ago. You enjoyed the service, but because you reached a point where had enough underwear, you cancelled your subscription.

One day, around a year after you originally canceled, they send you an email with an offer you find hard to refuse (some of the old pairs might have worn out a little, right?).

As you can see in the email, they send you a promotional offer that promises a free mystery pair plus €10 shopping credit in their loyalty store (a store of items you can only get with loyalty credit). After clicking the link, the crafty store also offers a socks membership with the first month free.

Perhaps all of this effort to win you back succeeds, and you even add a socks membership to upgrade your subscription – this serves as a great example of what you want to do with customers who may be churning from your ecommerce store.

In this guide, we’ll be covering all things customer churn; why it matters, how you can predict it, and methods (like the example above) of reducing churn rates in ecommerce stores.

What is customer churn, and why does it matter?

Customer churn is the rate at which you lose your customers (usually a percentage) in a given period. Customer churn rates are vital for ecommerce stores that offer subscriptions (like the example above), but it’s also a good metric to keep an eye on for other business models.

It’s easy to calculate your customer churn rate by dividing the number of customers you lost over a period (e.g., during a month or quarter) by the number of customers you had at the beginning of the period.

But why is it important? No business, particularly in ecommerce, is immune to customer churn (if you know one, let us know!). Since it’s generally accepted that everyone loses customers occasionally, you might not prioritize investigating and improving your customer churn rate—but that would be a mistake.

We all know that acquiring new customers costs more than retaining existing ones. We explained this in greater detail in our post on customer retention costs. So focusing on reducing customer churn (which inversely improves retention) is a cost-effective strategy for increasing overall profits.

How can you predict customer churn?

It’s one thing to know when a customer has already left, and it’s another to predict if they are about to leave. With the latter, you have a much better chance of stepping in with a retention tactic to prevent the churn from happening. So how can you predict it?

Investigate the experiences of your churned customers

It’s not always a complete loss if a customer has already churned. You can use their experience as a reference point for potential customers who might follow in their footsteps.

See if you can survey your churned customers for qualitative data on why they left your business.

You can also look at the quantitative data by looking at trends in your churned customers—how old are they? Is there a gender that churns more? Is there a typical customer lifetime length among them?

All these questions can help you understand your churned customers more and, based on their answers, help identify existing customers you can flag as “at risk” of churning.

Analyze behavioral data

Other than demographic data among your churned customers, you can also analyze behaviors that led to customers churning. For example, you might notice that before many customers churn, they pause their subscriptions, are late paying them, or increase their customer service interactions (to try to solve an issue).

Another common indicator of a customer about to churn is that they’ve stopped using the product (if applicable)—a customer not using the product will likely churn.

Whichever the case, the key is finding the trending behaviors among them and seeing if anyone in your existing customer base is demonstrating some of them—if so, you can flag them as “at risk.”

Use a dedicated tool

An easy way to find all this information is by using an analytical reporting tool like our Customer Value Snapshot, which automatically segments your customers based on their loyalty, at-risk, and churned status.

This tool makes identifying your at-risk customers more straightforward and helps you gather other valuable metrics, such as average order value and repeat purchase rates, giving you a better understanding of what leads to repeat purchase behavior.

Once you’ve identified customers at risk of churning, you can turn to some of the following methods to ensure they stay with your brand instead of moving to a competitor.

Methods to reduce customer churn

Winning back a customer that hasn’t left your brand just yet is both an art and a science. You need the data from your reporting tool or manual analyses to identify them, but you need skillful copywriting and design to entice them back. Let’s take a look at some of those tactics.

Win-back messages

Using a tool like the Customer Value Snapshot, you can send the customers who are at risk of churning hyper-targeted win-back messaging designed to be irresistible. Here’s an example that doesn’t involve giving away free products:

In this case, Blue Apron (a meal subscription service) offers customers a discount on another order. Chances are, the customer that received this email hadn’t ordered a meal for a long while, so Blue Apron’s segmentation would have identified this customer as about to churn.

Win-back messages are super easy to set up too—with the email service provider you choose, you can set up an automatic email sequence that triggers if a customer hasn’t ordered anything in a specific time frame.

Collect more customer data

The following strategy is incentivizing customers to share more personal data (such as filling out an account profile) and using that data to offer a more personalized marketing experience.

Not too long ago, McKinsey & Company surveyed consumers and found that 71% expected personalization from brands, 76% were frustrated when they didn’t get personalized messages from brands, and 67% felt that personalization was important for giving them relevant product and service recommendations.

However, simply asking your customers to hand out more personal information just won’t cut it. You need to give them something in return. That’s where a good loyalty program can come in.

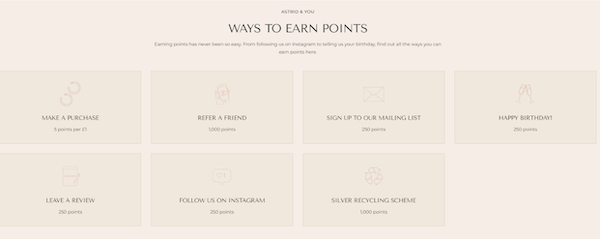

Astrid & Miyu is a brand that uses LoyaltyLion to build up its customers’ lifetime value (which helps prevent churn). They incentivize customers to share more personal information by offering rewards in return:

Their loyalty program offers points for personal information such as birthdays, social media profiles and email addresses, etc. The more the customer shares, the more rewards they get—win-win.

Use loyalty tiers

The next method to prevent churn is using a tiered loyalty system. Loyalty tiers encourage your customers to engage more with your brand and purchase more frequently to achieve a better tier of rewards. Once your customers feel like they’re working towards something, they’re less likely to abandon you for a competitor because they have an additional motivation to stay.

You can tie this tactic with the previous one in that completing your account information (with extra details for rewards) can help move the customer into a new rewards tier. The incentive here is that the basic tier (signing up without giving further information) would only have a smaller offering of rewards with fewer benefits compared to the next tier.

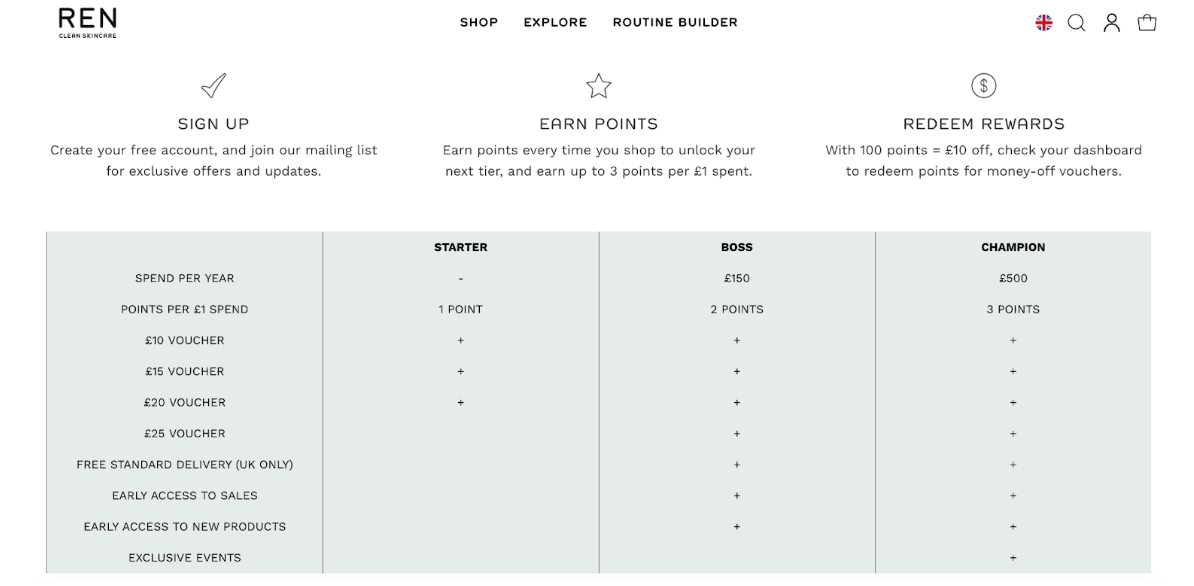

One brand that uses this strategy well is REN Skincare:

REN Skincare’s loyalty system includes three tiers: Starter, Boss, and Champion. Customers are automatically enrolled into the Starter tier, but they can move up tiers based on annual spending—increasing the value of their rewards.

Use helpdesk integrations

We mentioned earlier a behavior that is indicative of a customer at risk of churning: increased customer support interactions. If customers have issues with your product or service, they’re more likely to go to a competitor if they think it’ll save them time and effort.

Besides hiring more customer support staff (which isn’t always an option), you can upgrade your tech stack to help improve your customers’ experiences.

If you use Shopify to host your store, you can use the Gorgias integration with LoyaltyLion. Gorgias, on its own, is a powerful tool for creating exceptional customer support experiences—and you can elevate this experience even further by incorporating your loyalty data into your interactions.

By using a tool like Gorgias, you can identify opportunities for enriched experiences while at the same time automating tickets that don’t need a human touch (we found 40% of tickets could be automated with Gorgias). These personalized interactions led to a 195% higher spend in VIP customers (identified with LoyaltyLion).

Use email and SMS integrations

The final tactic is one of the most basic—ensure you can reach your customers. Using email and SMS integrations with your loyalty program software skyrockets the effectiveness of both systems since any communication can be hyper-personalized with loyalty data.

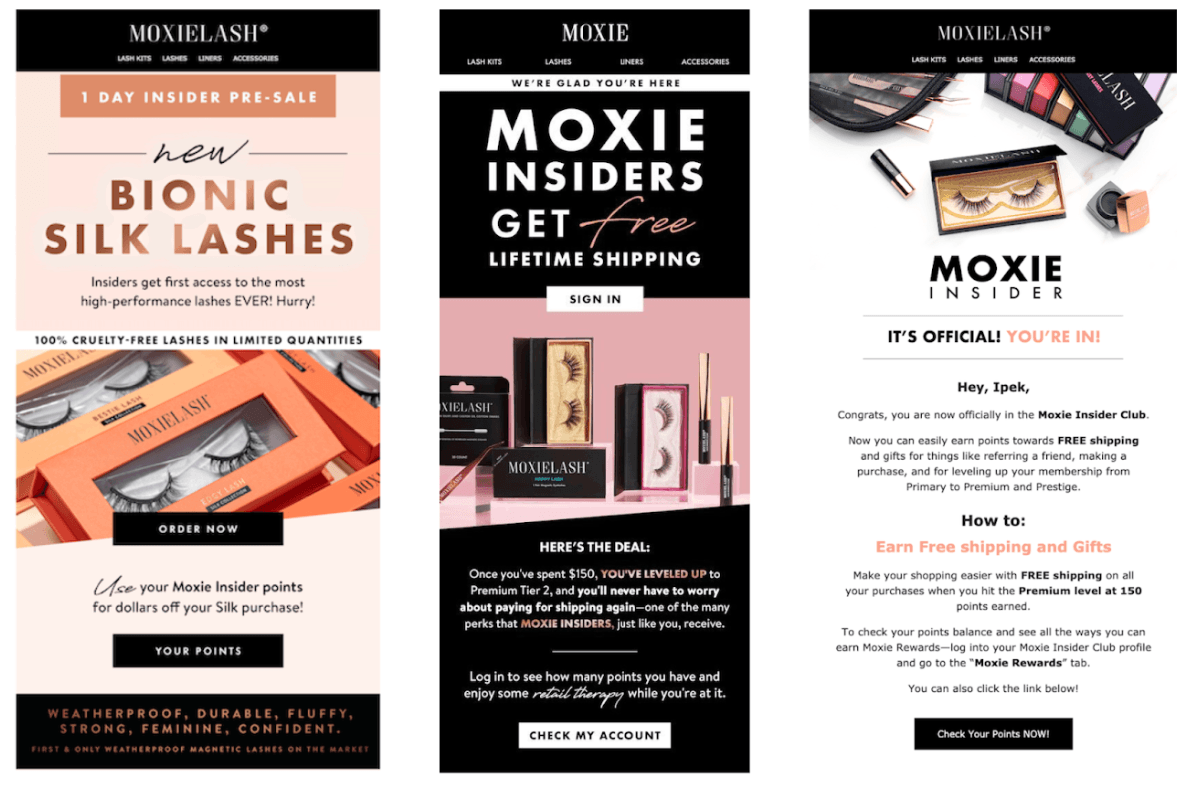

One brand that has maximized email and SMS effectiveness with loyalty data is MoxieLash. Using the Klaviyo x LoyaltyLion integration, MoxieLash built the MoxieLash Insider program, which includes several email sequences:

- Welcome email

- Tailored post-purchase emails (to members and non-members)

- Tier upgrade and downgrade notifications

- Monthly reward reminders

- Rewards and points for birthdays

These regular personalized emails boosted loyalty activities from 21,000 to a peak average of 160,000 completed activities in the MoxieLash Insider program. In turn, this led to:

- A 3x increase in loyalty program members returning to make a second purchase

- Redeeming members purchase 2.75x more frequently per year than non-members

- 1.5x higher average number of orders from loyalty program members than non-members

- 1.5x higher average spend from loyalty program members than non-members

Slash your customer churn rate with LoyaltyLion

We all know that customer churn is a natural part of doing business in the ecommerce industry, but it doesn’t have to be a mysterious figure you can’t do anything about.

In this guide, we showed you five methods you can use to reduce your customer churn rate:

- Use win-back messages to get back customers who are most at risk

- Collect more customer data so you can provide more personalized experiences

- Use loyalty tiers to incentivize customers to engage more

- Use a helpdesk integration with your loyalty program, such as Gorgias, to upgrade your customer support

- Finally, use an email and SMS integration with your loyalty program, such as Klaviyo, to make more use of loyalty data in your email and SMS campaigns.

One tool that can help you execute all of these methods is our dedicated loyalty program software: LoyaltyLion.

With LoyaltyLion, you can build a tailor loyalty program for your ecommerce store and mix-and-match the above tactics to create a powerful retention strategy that’s ready to slash your customer churn rates.

Book a demo with us today to learn how LoyaltyLion can help your ecommerce brand with its loyalty strategy.