It wasn’t too long ago the fashion store Never Fully Dressed was facing the challenge of wanting to enhance its brand identity and grow its community to even further heights. So how did they end up getting a 64% increase in repeat purchases? By focusing on their customer retention strategy. After building out its loyalty program, NFD now drives 32% of its revenue from loyal customers.

While customer acquisition remains crucial for growth, the NFD example demonstrates the potent impact of retention strategies. However, achieving optimal business health necessitates a balanced approach, avoiding an “either/or” mentality. The challenge for many ecommerce store owners lies in effectively allocating resources to address both sides of the customer journey.

This guide will walk you through the difference in cost between customer retention and acquisition. But since customer retention is our speciality, we’ll also go into more detail about retention rates and optimizing your strategies in this area. The topics we cover include:

- The cost of customer retention vs. customer acquisition

- Data-driven strategies to improve customer retention

- How to calculate customer retention costs: formulas and examples

- What is a good customer retention rate?

- REN skincare: a customer retention case study

- Customer retention statistics that prove that retention pays off

Continue reading to fully understand your store’s customer retention costs.

The cost of customer retention vs. customer acquisition

Determining the precise cost discrepancy between customer retention and acquisition presents a multifaceted challenge. For example, relativity plays a significant role. The colossal paid social expenditures undertaken by Big X Corporation do not necessitate similar investments for your ecommerce store.

We do know, however, that in the US, between January 2018 and November 2022, the average cost per lead (CPL) via paid channels in ecommerce was $98, while organic CPL was $83.

We’ll illustrate the differences across channels with some industry-wide examples of spending with separate figures of effectiveness. Let’s start with acquisition cost and spending.

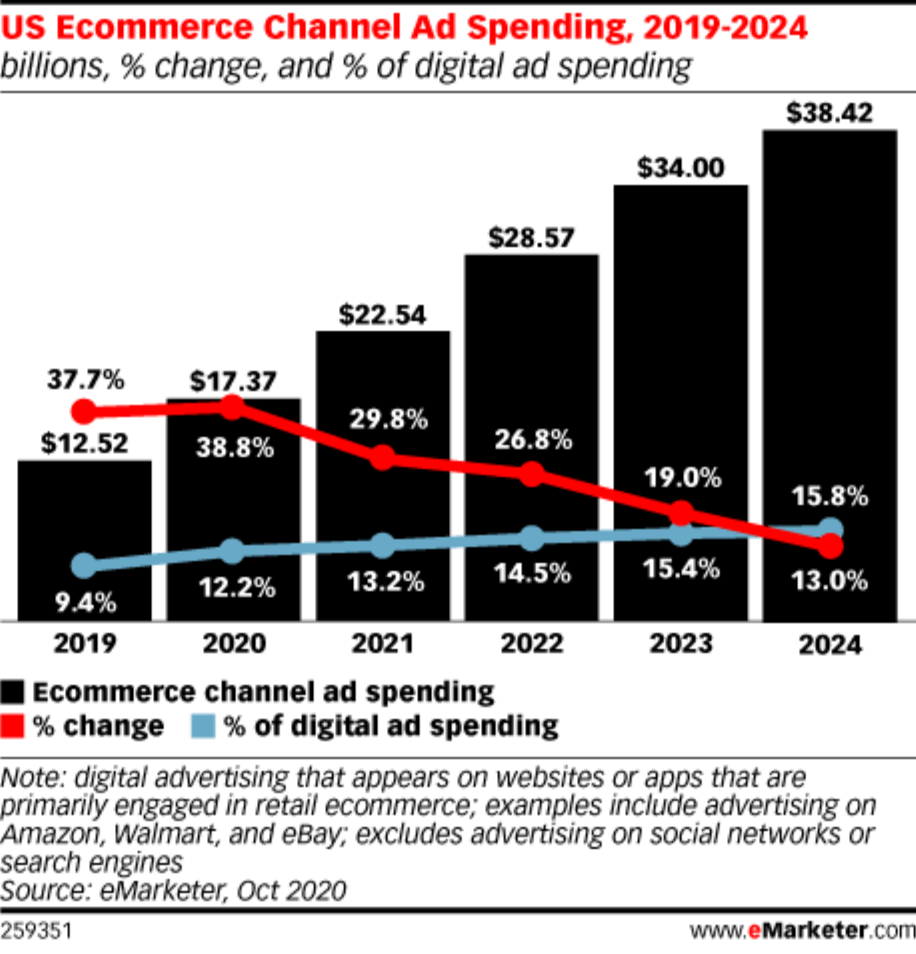

Stuart Crowley from the ecommerce expo says the industry estimates suggest customer acquisition costs have increased by 60% in the last five years. Which is a pretty huge increase in that period.Folks at Insider Intelligence suggest the ecommerce channel ad spending was $12.52 billion in 2019; fast forward to 2022, and this figure jumps to $28.57 billion. They do specify that Amazon makes up about three-quarters of the ad market in this case—with remaining competitors Walmart and eBay driving most of the remaining share.

From the IAB/PwC 2022 report, we can see that spending in paid channels keeps growing (though not at the levels they did during the pandemic)—with digital audio at 20.9%, video at 19.3%, display ads at 12%, search ads at 7.8%, and social ads at 3.6%. To top it off, the average cost per click (CPC) across all industries is $2.69.

When it comes to retention spending, this picture is a little less clear. The team at Antavo suggests almost half of the organizations they surveyed (48.3%) confirmed they’re planning to offer personalized rewards and offers in the next three years. In their 2023 report, they also said, “67.7% of businesses plan to increase or significantly increase their investments in customer retention in the inflation crisis and potential recession”.

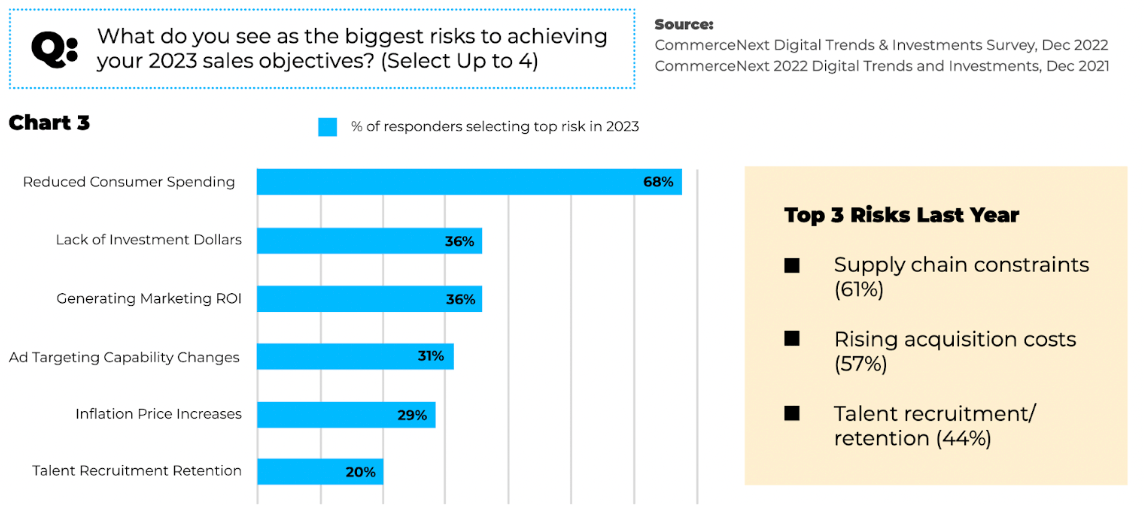

But how effective is this acquisition spend? Unfortunately, it’s not looking great. In their 2023 report, CommerceNext says 68% of surveyed retailers reported declining performance on paid social and that ad targeting capability changes are a big problem for them.

Recent capability changes are attributable, at least partially, to Apple’s revised data privacy policies within iOS. These updates restrict cross-app data sharing unless users explicitly opt in. While this undoubtedly empowers consumers, it has concurrently diminished the effectiveness of advertising within platforms like Facebook and Instagram.

On the other hand, inside PYMTS June Report, research shows 79% of revenue for subscription providers is generated by the top 30% of loyal subscribers. At LoyaltyLion, we’ve also found that emails sent using loyalty program information have a 20% click-through rate.

Finally, in Bond’s 2022 Loyalty Report, we get a lot of positive data points on the effectiveness of retention programs, including:

- Program members spend more when they feel loyalty to a brand ($26 lift from program members, and $50 lift from credit card holders).

- When brand purpose aligns with customer values, they are 3.4x likely to recommend the brand, 9.8x likely to go out of their way to do business with your brand, and 9.9x as likely to spend more with your brand.

So with all of this information in mind, it’s clear that customer retention strategies are vital in helping offset the increasing costs of customer acquisition.

Data-driven strategies to improve customer retention

Utilizing data-driven strategies to improve customer retention is paramount for any business. Below, you’ll find a compilation of ten top-notch customer retention strategies, along with their respective benefits and methods for measurement. These strategies are tailored to optimize customer satisfaction, minimize churn rates, and foster long-term brand loyalty, offering Shopify stores a robust framework for sustainable growth and success.

| Customer retention strategy | Benefits | How to measure |

| Predict churn risk: Utilize historical data and analytics to identify customers at risk of leaving, allowing you to proactively intervene. | Minimize churn rate, optimize resource allocation, and identify areas for improvement. | Track churn rate by segment and intervention conversion rate. |

| Customer segmentation: Segment your customer base based on demographics, behavior, and preferences for targeted engagement. | Deliver personalized experiences, boost customer satisfaction, and increase engagement. | Monitor engagement metrics (open rates, click-through rates) per segment. |

| Personalized communication: Tailor communication channels, messaging, and offers to individual customer preferences and loyalty behaviors. | Enhance relevance, improve click-through rates, and strengthen customer relationships. | Analyze open rates, click-throughs, and conversion rates for personalized campaigns. |

| Loyalty programs: Implement reward programs that incentivize repeat purchases and engagement. | Loyalty program benefits include driving customer lifetime value, build brand advocacy, and foster emotional connections. | Track participation rate, average purchase value of loyal customers, brand sentiment. |

| Feedback and sentiment analysis: Analyze customer feedback through surveys, reviews, and social media to identify pain points and opportunities. | Understand customer needs, proactively address issues, and tailor offerings for higher satisfaction. | Monitor Net Promoter Score, feedback response rate, sentiment analysis score. |

| Proactive customer service: Offer exceptional customer service through multiple channels to resolve issues promptly and effectively. | Increase customer satisfaction, reduce churn, and build trust and loyalty. | Measure customer satisfaction score for support interactions, first contact resolution rate, average time to resolution. |

| Community building: Create online communities or forums where customers can interact, share experiences, and feel valued. | Foster brand loyalty, encourage peer-to-peer recommendations, and generate valuable customer insights. | Track community engagement metrics (posts, comments, likes), sentiment analysis, and acquisition rate from community. |

| Content marketing: Share valuable content relevant to your customer needs and interests through various channels. | Educate and engage customers, establish thought leadership, and drive organic traffic and conversions. | Analyze website traffic & engagement metrics, lead generation & conversion rates from content marketing, social media engagement with content. |

| Omnichannel experience: Ensure a seamless and consistent customer experience across all touchpoints. | Reduce frustration, increase convenience, and provide a positive brand perception. | Conduct customer satisfaction surveys for specific channels, track Net Promoter Score for omnichannel interactions, use website analytics to identify friction points. |

| A/B testing: Experiment with different strategies and content to optimize effectiveness and personalize the customer journey. | Continuously improve customer engagement, identify best practices, and maximize ROI. | Compare conversion rates for different variations, assess statistical significance of tests, track improvement in key engagement metrics. |

How to calculate customer retention costs: formulas and examples

We recently published an article on the customer retention definition that goes into a lot of detail about different rates associated with retention (such as churn rate, repeat purchase rate, time between purchases, and more).

However, customer retention costs (CRC) are slightly different than these regular rate-based metrics.

CRC is basically how much you spend on attempting to retain your customers over a given period. There are two good formulas for helping you calculate your CRC; the first one is simple:

CRC = (total cost of customer success and retention schemes/initiatives) ÷ (number of active customers) x 100

Let’s look at an example. Imagine your total costs associated with retention (including loyalty program costs, email service provider fees, salaries of anyone specifically assigned to retention initiatives, etc.) for the previous 30 days was $8,000, and you had 3,000 monthly active customers. In this case, your average CRC would be $266.66 per customer.

However, this assumes each customer has equal value—which we know isn’t the case. If you want to find out the average lifetime CRC of individual customers, you can multiply the average CRC from above by the average customer lifetime.

In this case, let’s say your business is subscription-based, and your average customer lifetime is 3 years—the lifetime CRC of your average customer would be $799.98.

What is a good customer retention rate?

The success of an e-commerce store’s customer retention rate (CRR) is intertwined with its chosen niche. In instances where bulky furniture constitutes the primary product offering, achieving a particularly high CRR within a short timeframe becomes unlikely. However, extending the measurement period across several years can yield significantly different results.

However, subscription-based stores, consumables (such as supplements), and clothing stores should typically have a higher CRR. On average, between 70–80% CRR is good for most industries. If your CRR is lower than that, it could be to do with your niche—but it’s always worth figuring out if you can improve your retention rates regardless.

Curious what a “good” customer retention rate (CRR) looks like for your niche? While it’s not a one-size-fits-all answer, our table below offers estimates for some popular e-commerce niches. We also dig into the reasoning behind these rates, based on purchase frequency, emotional connection, and other factors.

| Niche | Good retention rate | Reason |

| Subscription boxes: (Beauty, food, pet supplies, etc.) | 80-90% | Recurring revenue model fosters higher loyalty. |

| Consumables: (Vitamins, coffee, pet food, cleaning products) | 70-80% | Regular replenishment drives repeat purchases. |

| Fashion and apparel | 65-75% | Trends and seasonality influence repurchase frequency. |

| Cosmetics and skincare | 60-70% | Brand loyalty and product personalization play a role in the cosmetic industry’s high loyalty rates. |

| Electronics and appliances | 55-65% | Longer replacement cycles impact retention rates. |

| Furniture and homeware | 45-55% | Infrequent purchases but high potential for lifetime value. |

| Travel and experiences | 40-50% | Destination, price and experience shape repeat bookings. |

| Fitness and wellbeing (gyms, apps) | 60-70% | Engagement and value proposition are key retention factors. |

Please note: These are estimated ranges and the “good” rate can vary depending on specific factors like business model, target audience, and market competition. It’s important to benchmark against your industry and track your own CRR to measure progress and identify areas for improvement.

REN skincare: a customer retention case study

Customer retention case studies are the best way of illustrating how using data-driven decisions to influence your retention strategy impacts your bottom line.

For example, we saw the stat earlier that said, “Program members spend more when they feel loyal to a brand ($26 lift from program members, and $50 lift from credit card holders)”. But can we see this in action? Yes we can!

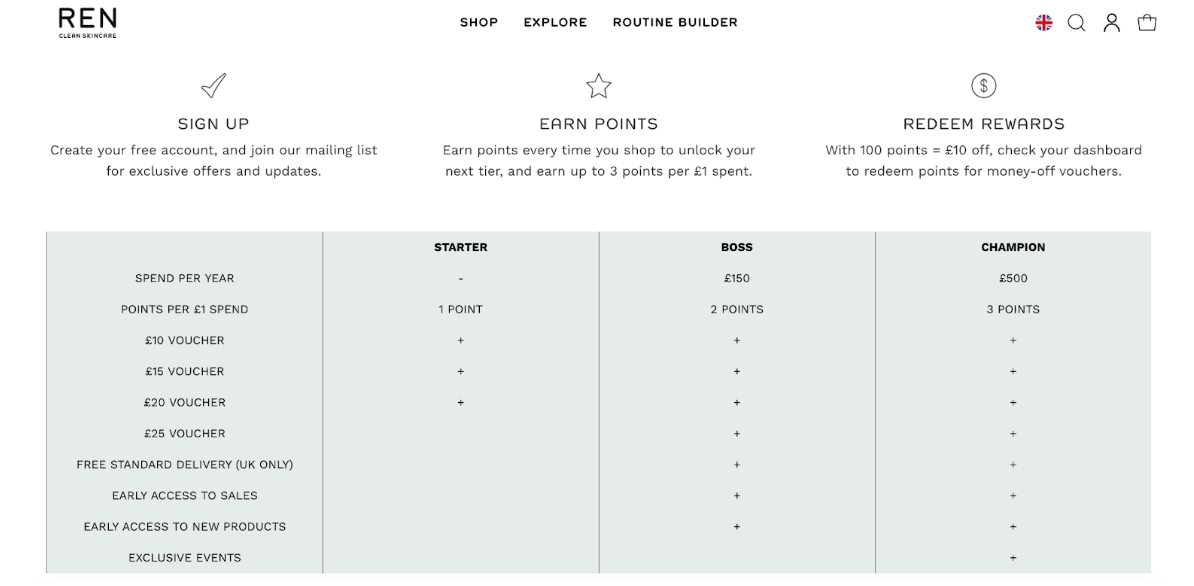

In the case of REN Skincare, they created a fully-customized, integrated loyalty page for turning loyalty members into advocates—which saw a 68% increase in customer spending by program members, as well as 63% higher repeat purchase rates than guest visitors.

Similarly, by adopting a long-term loyalty program strategy, Waterdrop increased its customer spending by 90% and repeat purchase rates by 70%. In this case, Waterdrop now uses its retention strategy hand-in-hand with its acquisition strategy (by promoting its loyalty program via paid ads), which helps reduce acquisition costs.

If you want to discover which specific strategies brands are using to improve their retention rates, including setting up a tiered loyalty program and making better use of their customer data, you can find a full list here.

Customer retention statistics that prove that retention pays off

Unlocking the potential of customer retention opens the door to a host of benefits, as evidenced by these compelling statistics that underscore its profitability and strategic significance. Delving into these customer retention statistics reveals a clear advantage: retaining customers not only proves more cost-effective but also yields higher returns on investment.

- Cost advantage: Acquiring a new customer costs 5x more than retaining an existing one (Harvard Business Review).

- Higher ROI: A 5% increase in customer retention can boost profits by up to 75% (Bain & Company).

- 80/20 rule: According to Gartner, 80% of a company’s future revenue will come from just 20% of its existing customers (Forbes).

- Probability of selling to existing customers: According to the book Marketing Metrics, the probability of selling to an existing customer is 60-70%, while the probability of selling to a new prospect is 5-20% (Forbes).

- Word-of-mouth influence: Happy customers who get their issues resolved tell about 4-6 people about their positive experience (Zendesk).

- Customer Loyalty Impact: 69% of consumers are more likely to become loyal to a brand if they are offered rewards (Annex Cloud).

Start offsetting your customer acquisition costs with LoyaltyLion

While we mentioned earlier that prioritizing retention is key, that doesn’t mean shutting the door on new customers! Your business still has room to bloom beyond your current base, wouldn’t you agree?

However, to offset the rising costs of attracting new customers, using a solid loyalty program software like LoyaltyLion helps ecommerce businesses like yours maximize the value of your existing customers.

By increasing your existing customer lifetime value and average spend, you get more wiggle room for reinvesting in your advertising efforts to help grow your business sustainably for the long term.To learn how LoyaltyLion can help your ecommerce brand with customer retention, book a demo with us today.