Customer Lifetime Value (CLV) is an important metric for anyone in the ecommerce space — including Shopify store owners. It helps you see how well your brand is retaining loyal customers and provides a benchmark for improving your loyalty strategy.

In this guide, we’re going to show you step-by-step how to calculate the lifetime value of your Shopify customers, as well as outline some measurement and improvement tips.

How to calculate CLV using Shopify

To get straight to the point, this is the formula you need to calculate your Shopify CLV:

(Average Order Value x Purchase Frequency) x Average Customer Lifespan

There are three key calculations that make up the whole formula, and you might not have all of them right away. Let’s break down these calculations in the order they appear.

Remember to have a specific time frame in mind for each step, such as a year or a quarter.

Step 1. Figure out your Shopify Average Order Value

Manually calculating your Average Order Value (AOV) or Average Transaction Value (ATV) is actually pretty simple. You can do it with this formula:

AOV = Total Revenue / Number of Transactions

Let’s say your business generated $320,000 last year with a total number of 4571 transactions.

$320,000 / 4571 = $70 Average Order Value.

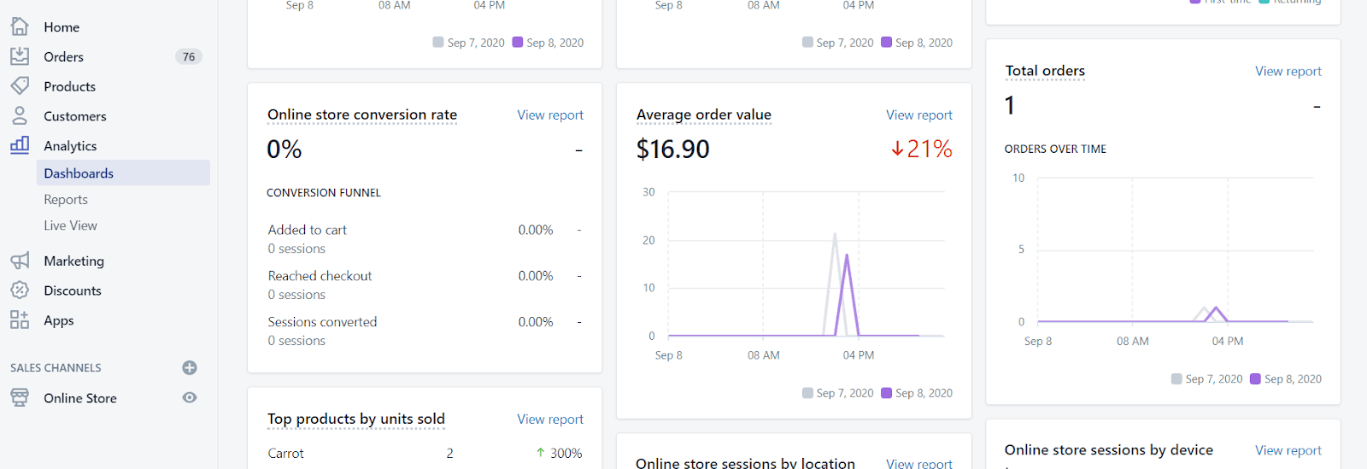

Even if this calculation is simple, Shopify saves you time by including the AOV of your store in your Analytics Dashboards.

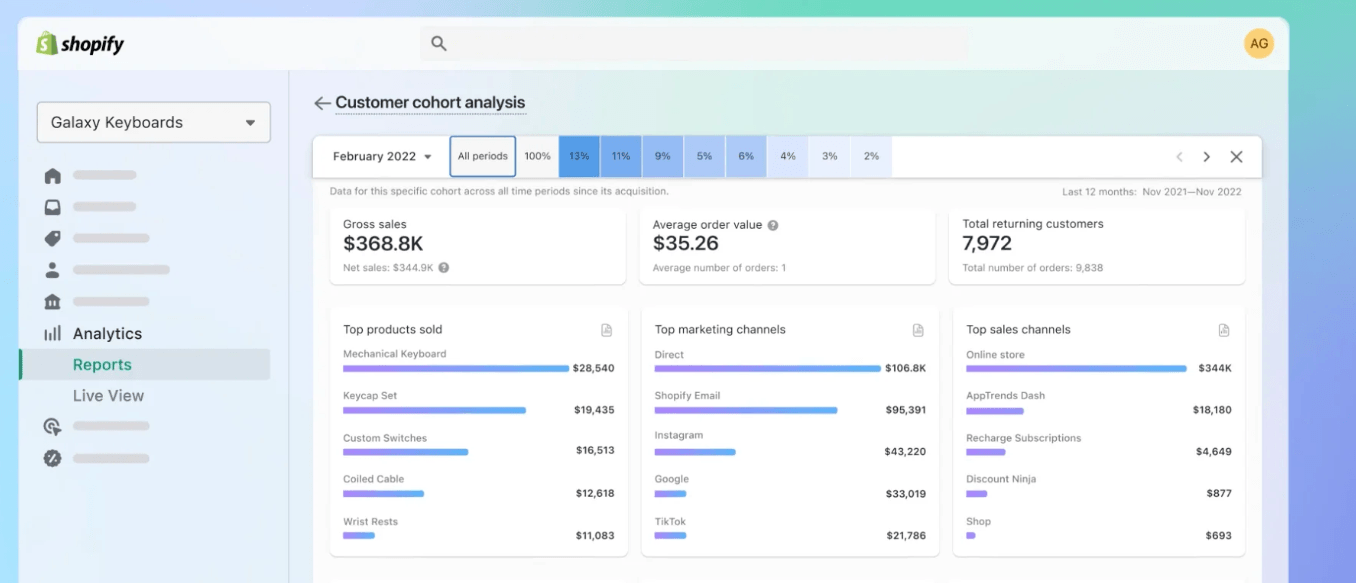

On the default dashboard settings, you get daily AOV updates. But if you want to measure a longer time period, you can go to Shopify’s Cohort Analysis and also find the AOV for the periods you want:

With your AOV in hand, we can move on to finding your average purchase frequency.

Step 2. Figure out your Shopify customer’s purchase frequency

Similarly to AOV, figuring out your customer’s purchase frequency is straightforward. Here’s the formula you need:

Number of purchases / Number of unique customers

We mentioned our hypothetical Shopify store had 4571 orders last year, of those orders, there were 1500 unique customers.

4751 / 1500 = 3.04 (each customer purchased on average three times in the year).

Unfortunately, unlike AOV, purchase frequency is not a metric included in the default Shopify Analytics or reports. So, you will have to calculate this one manually.

That said, Shopify includes Total Orders and Customers Over Time on your default dashboard view, which gives you the information you need to complete this formula.

Step 3. Figure out your customers’ average lifespan

ore owners because you don’t have a “contract” in place (like a monthly subscription) that tells you exactly when a customer has churned (i.e.,Here’s where things get a little more tricky. Figuring out your average customer lifespan can be difficult for Shopify st canceled their subscription).

Instead, you need to determine the customer’s average purchase interval, which will lead you to your average lifespan.

You can find purchase interval data by heading to Shopify’s Analytics dashboard under the “Returning customer rate” and measuring the average repeat purchase timeline within a “customer cohort” (which helps define a start date for measurement) or for all of your customers.

With this information, you can follow a rule of thumb: Consider customers whose time since their last purchase was 3x the average purchase interval as churned. You should have a list of customers who have “churned,” which gives you their lifespan data.

From there, you can use this formula:

(Sum of all customer lifespans / Total number of customers)

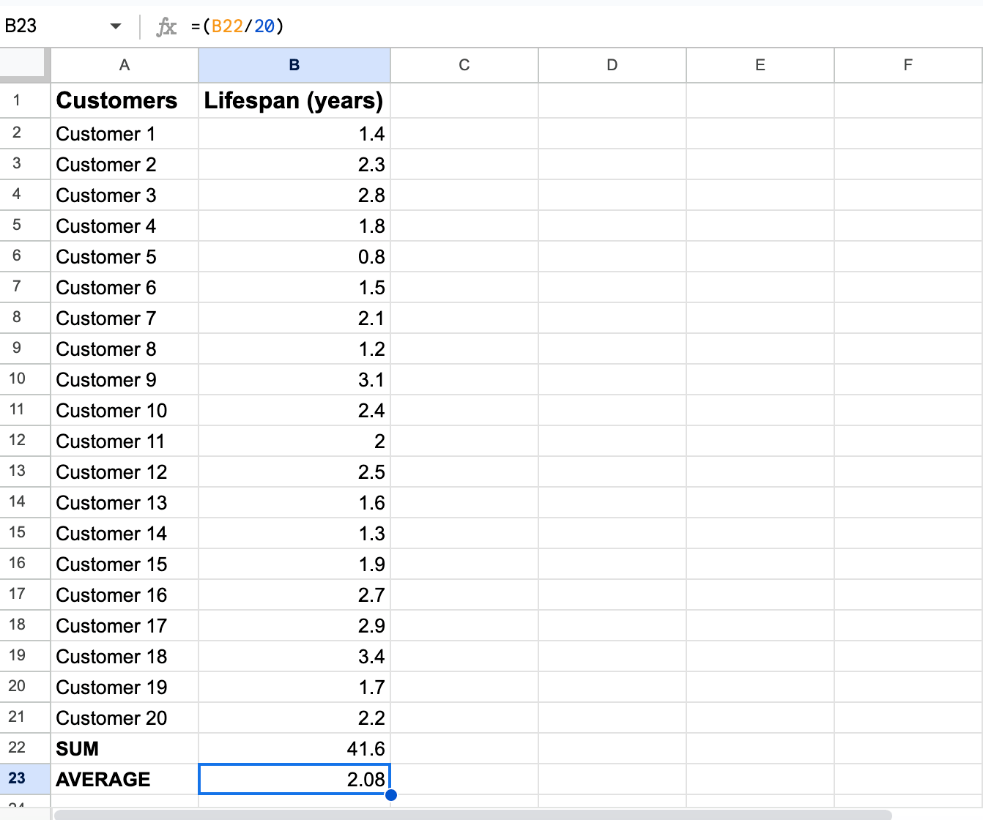

Here’s an example of what that could look like:

In this case, we have an average lifespan of 2.08 (years)

With your average customer lifespan in hand, you can now complete the CLV formula.

Step 4. Put it all together for a CLV formula

So, as a reminder, the full formula for calculating your Shopify CLV is:

(Average Order Value x Purchase Frequency) x Average Customer Lifespan

With the example figures we’ve used above, we can fill in the formula:

- Average Order Value = $70 ($320,000 / 4571)

- Purchase frequency = 3.04 (4751 / 1500)

- Customer lifespan = 2.08

- CLV = $442.62

Or phrased as a formula ($70 x 3.04) x 2.08 = $442.62

And there you have it. It’s worth mentioning that this formula uses revenue-based figures. If you wanted to figure out a profit-based CLV, you’d need to take away your average customer acquisition costs from your revenue-based CLV. Or you can use a CLV:CAC ratio to measure up the differences, as we’ll explain below.

Alternatively, if you choose to use LoyaltyLion for your loyalty program needs, itsCustomer Analytics dashboard calculates CLV for you, automatically.

A “good CLV” depends on your acquisition costs

You may have a super high CLV, but it doesn’t mean anything if it costs more than that to acquire your average customer. If your acquisition costs are higher than your CLV, you’re spending more than your customers are giving back to you (on average). That’s not good.

To help you determine whether your CLV is on the right path, you need to figure out your customer acquisition costs (CAC) and compare them in a ratio.

Here’s the formula for calculating CAC:

(Cost of Sales + Cost of Marketing) / Number of New Customers = CAC

Your cost of sales may include things like:

- Payment processing fees

- Sales team salaries

- Shipping costs

While marketing costs can be anything from:

- Pay-per-click (PPC) advertising

- Contractor payments

- Marketing software subscriptions (e.g., email marketing or CRM)

In Shopify, you’ll have access to Profit margin reports and a Sales finance report, which can help you understand some of these figures.

But, let’s plug in some numbers:

($25,000+ $30,000) / 500 = $110 CAC

With our hypothetical store in mind, our CLV:CAC ratio is $442:$110, which is a little over 4:1.

A good rule of thumb is that a good CLV is at least 3x your CAC (in other words, at least 3:1). So, our hypothetical store has a great CLV:CAC ratio.

How to predict CLV in Shopify

With Shopify, you have access to the “Predicted spend tier.” This feature tells you whether a customer cohort will likely be “low,” “medium,” or “high” spenders, but it doesn’t provide any predicted CLV figures.

However, it is possible to use a predictive model to look at a customer’s future value.

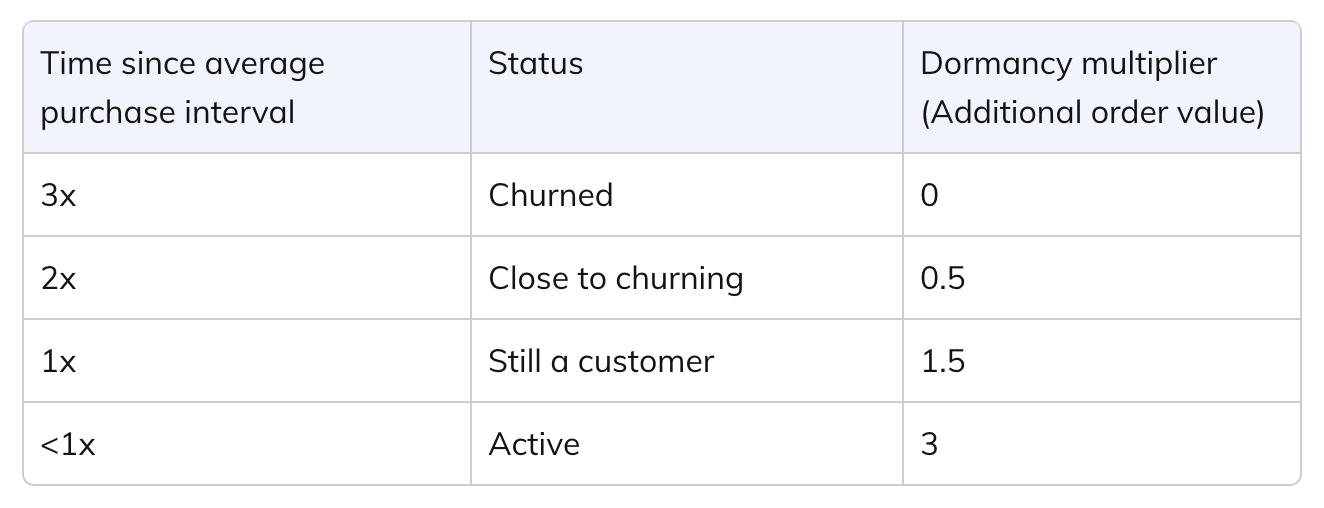

It uses the same 3x purchase interval rule but with a few extra intervals to get more granular. However, the base formula is as follows:

All revenue + (Dormancy multiplier * Average order value)

Here’s a table for figuring out the dormancy multiplier based on time since the average purchase interval:

For examples using figures, check out the LoyaltyLion help article that explains the model in more detail. LoyaltyLion uses this model for its customer analytics dashboard (so if you sign up to LoyaltyLion, you won’t need to do this manually).

How to improve your Shopify CLV

Now that you know how to calculate your Shopify CLV, let’s look at some strategies for improving it.

Use email marketing automation

As a Shopify store owner, you’re likely already using marketing automation for sales, product launches, and other important communication. With your CLV data, you can take it a step further.

Segment your customers into “high,” “medium,” and “low” value groups using either Shopify’s built-in segmentation tool or loyalty data. Once you have these segments, get creative with email marketing campaigns.

Target your mid-to-low-value customers with deals like product bundle offers based on their previous buys to encourage more purchases. This tactic can boost their AOV, and in turn, their CLV.

If you’ve got a loyalty program set up (and if you don’t, now’s the time!), use email integrations such as Klaviyo to keep high-value customers coming back. Send automated emails encouraging them to redeem their rewards. It’s a win-win – they get a treat, and you improve your CLV metrics.

Use loyalty tiers

Many Shopify brands use a simple, points-based loyalty system where points = discounts. However, this approach creates an inherently transactional relationship.

Building strong, emotional customer loyalty can help improve CLV by keeping customers engaged, and extending their potential lifespan (and AOV).

Tiered loyalty programs don’t have to impact your bottom line either (i.e., you don’t have to offer bigger discounts). You can create experience-based rewards for your customers like first dibs on new products, early access to sales, and VIP passes to events.

As an example of a brand using loyalty tiers to boost CLV, look at Never Fully Dressed.

With a goal to build a stronger foundation of loyal customers, they created a tiered program that rewards brand engagement and purchases. Here’s what happened:

- The program now generates 32% of NFD revenue.

- The program increased loyal customer spending by 59%.

- The program increased repeat purchase rates by 64%.

Both increased spending and repeat purchase rates contribute to significantly higher CLV rates for your Shopify store.

The downsides of using CLV for Shopify stores — and some alternative metrics

Customer lifetime value is a metric that makes the most sense for businesses that can accurately (and more easily) measure customer lifespans. This includes software subscription companies that can easily tell when customers end their subscriptions.

For Shopify stores, measuring CLV is more difficult because you need to account for greater fluctuations in customer behavior, variable order values, and seasonal peaks and troughs.

On top of that, your customers can disappear for years and decide to return to make another purchase. That behavior can skew your lifespan averages quite a bit.

So, what are some alternative metrics that may offer better insight, or are just plain easier to measure?

Average Order Value

We mentioned Average Order Value as a critical part of the CLV formula. You could stop at AOV. It’s still a valuable metric on its own, as it tells you if particular initiatives help add more products to customers’ baskets.

Here’s a reminder of the formula:

AOV = Total Revenue / Total Orders

Plus, AOV is a default metric that’s available on your Shopify dashboard.

Repeat Purchase Rates

We also mentioned Repeat Purchase Rate as a component for figuring out your customer’s average lifespan. Like AOV, it’s a good indicator of customer satisfaction with your products.

If your RPR is low, it means customers aren’t satisfied and you can work on solutions to improve their experience (which would also improve their CLV).

Here’s the formula for working this one out manually:

RPR = (Number of customers who have made repeat purchases / Total number of customers) x 100

In the end, you’ll get a percentage of customers who come back to purchase again.

In Shopify, you can get a similar insight from the Returning customer rate report.

Customer Satisfaction

With Shopify Email or third-party email integration, you can send your customers Customer Satisfaction (CSAT) surveys after they make a purchase. This data will help you better understand where you can improve the customer experience, which can, in turn, improve CLV.

The formula you need is based on survey responses:

CSAT = (% of Satisfied responses) / (Total responses) x 100

Maintaining a high CSAT score indicates that your customer retention program is on the right track.

Churn Rates

We also mentioned churn rates as a core part of determining customer lifespans for your Shopify store. Although this is the trickiest part of the equation to determine, it’s still worth measuring.

A high churn rate tells you that you’re not retaining customers well, and you’ll inevitably spend more on customer acquisition.

We have a guide for calculating ecommerce churn rates, as it’s different from the typical MRR model you’ll see in other guides online.

How a loyalty program can improve your Shopify CLV

A loyalty program, regardless of type, can help improve your Shopify CLV. How? Here are some of the benefits we’ve seen from our Shopify customers:

- Increases in average order value.

- Increases in repeat purchase rates.

- Increases in loyalty member spending.

- Greater engagement with the brand.

As we’ve already discussed, each of these factors has a significant impact on your customer’s CLV. If you build a loyalty program with LoyaltyLion, you get access to features such as:

- The ability to create a variety of loyalty program types.

- Customized rewards, specific to what your customers value most.

- A built-in referral program to generate more customer advocates.

- Integrations with popular tools like Klaviyo, Attentive, Gorgias, Verdn, Gatsby, and more.

Setting up LoyaltyLion with your Shopify store is easy with express setup. Or, if you’re looking for a more bespoke solution, the team at LoyaltyLion can get you a fully customized, on-brand loyalty program up and running in just 30 days.If you’re interested in seeing what LoyaltyLion looks like in action, take our 3-minute tour for a sneak peak!