For those in ecommerce, Customer Lifetime Value (CLV) is an important metric. However, when reading about it, it can often be related to terms like “monthly recurring revenue” or “subscription service.” This might have left you wondering whether you need to worry about CLV.

Yes, SaaS brands and other businesses with an MRR model have an easier time measuring CLV. For ecommerce business owners like you, it’s more difficult because your customers don’t necessarily spend the same amount of money each month and don’t “announce” their departure by canceling.

However, you can measure the CLV of customers in your ecommerce store, and there’s a fair amount of benefit in doing so.

So, for this guide, we’re going to cover what you need to know about ecommerce CLV, including:

- The importance of CLV

- Understanding the CLV:CAC ratio

- Does CLV make sense for ecommerce brands?

- How to calculate CLV in ecommerce

- What a “good” CLV is

- How to increase your CLV

- Other metrics to measure for ecommerce brands

The importance of CLV

Measuring, monitoring, and optimizing CLV offers many benefits. The practice can lead to greater customer retention, a better understanding of your customer base, and an overall improvement to your bottom line. But let’s take a look at some benefits in detail.

It offers financial stability

Measuring and optimizing CLV leads to greater financial stability because you can rely on your customers coming back for more products over a longer period of time.

For example, the fashion store Never Fully Dressed created a loyalty program to boost CLV and saw a 59% increase in member spending and a 64% increase in repeat purchase rates.

It helps segment high and low-value customers

You can measure each customer’s CLV as well as the overall average for your store, and in doing so, you can see which customers bring the most value. With this knowledge, you can target your lower-value customers with a retention-based email campaign or offer them product bundles/deals to increase their average order value.

It’s a helpful metric for understanding loyalty

The most obvious benefit is that CLV gives you a strong metric for understanding your customer loyalty—the higher your CLV, the more likely it is that customers will return to purchase products from your store over a long period of time.

A low CLV gives you data-backed evidence to invest in customer retention (if you need buy-in from other stakeholders).

Understanding the CLV:CAC ratio

CLV is a positive metric — in the sense that it will never be a negative number on its own. However, it’s a good idea to put it into context with the costs associated with acquiring customers (customer acquisition cost, CAC). In this context, you’ll see if you’re spending more on getting the customer than they’re giving back to you — which isn’t a good sign.

You’ll need to calculate your CLV:CAC ratio to get this insight. We’re going to dive deeper into calculating CLV further below in this guide, but for now, calculating your CAC is fairly easy:

(Cost of sales + cost of marketing) / Number of new customers = CAC

Generally speaking, your cost of sales will include things like:

- Payment processing fees

- Sales team costs (if applicable)

- Shipping costs

While the cost of marketing typically includes things like:

- Pay-per-click (PPC) advertising

- Marketing software subscriptions

- External contractor payments

Your brand may have more than what’s listed here, but you get the idea. With some numbers, the formula above would look something like this:

($5,000 + $10,000) / 100 = $150 CAC

With this figure in mind, you’ll have a better idea of the CLV you need to make a profit from your customers.

Does CLV make sense for ecommerce brands?

Remember that scenario I wrote in the introduction? You’ve probably heard about CLV, but seeing it coupled with MRR models likely made you think it wasn’t a metric you should measure.

Well, there is a fair amount of logic in that. The vast majority of advice out there regarding CLV only addresses MRR business models because it’s easy.

For ecommerce businesses, measuring CLV is more difficult because of the fluctuations in customer behavior, irregular purchase patterns, and variable order values. Additionally, what constitutes “customer lifespan” in ecommerce is a little murkier because your customers can simply disappear for a while and come back, perhaps years later, to make another purchase.

On top of that, ecommerce stores often have seasonal peaks and troughs — making it even more challenging to get accurate measurements.

As a result, calculating CLV for ecommerce stores requires more complex data that can be more difficult to get, especially if you need help determining what to look for.

However, just because measuring it is a little more difficult (at least at first) doesn’t mean it’s not worth doing—and we’ll teach you how to do it right now.

How to calculate CLV in ecommerce

Going straight into the formula you need to calculate CLV based on past data, here’s what you need:

(Average purchase value x purchase frequency) x average customer lifespan

Sounds pretty straightforward. But to get the whole formula, a couple of calculations are standing in your way, so let’s break those down. Remember, you’re using a specific time frame for all of the calculations (e.g., usually a year):

- To calculate your average purchase value, use the following formula: Number of purchases / number of unique customers

- To calculate your purchase frequency, use this formula: Number of purchases / Number of unique customers.

Multiplying the average purchase value by the purchase frequency gives you a “customer value,” which would shorten the overall CLV formula to:

Customer value x average customer lifespan = CLV

But of course, we still need to calculate the average customer lifespan, which is the most critical part of the equation for e-commerce businesses.

Calculating your average customer lifespan

Calculating your average customer lifespan requires determining your average purchase interval, which helps you find your average churn time.

You can find purchase interval data by heading to Shopify’s Analytics dashboard under the “Returning customer rate” and measuring the average repeat purchase timeline within a “customer cohort” (which helps you define a time period for measurement).

As a shortcut for churn time, you can use a general rule of thumb regarding ecommerce churn (which defines the end of a customer’s lifespan).

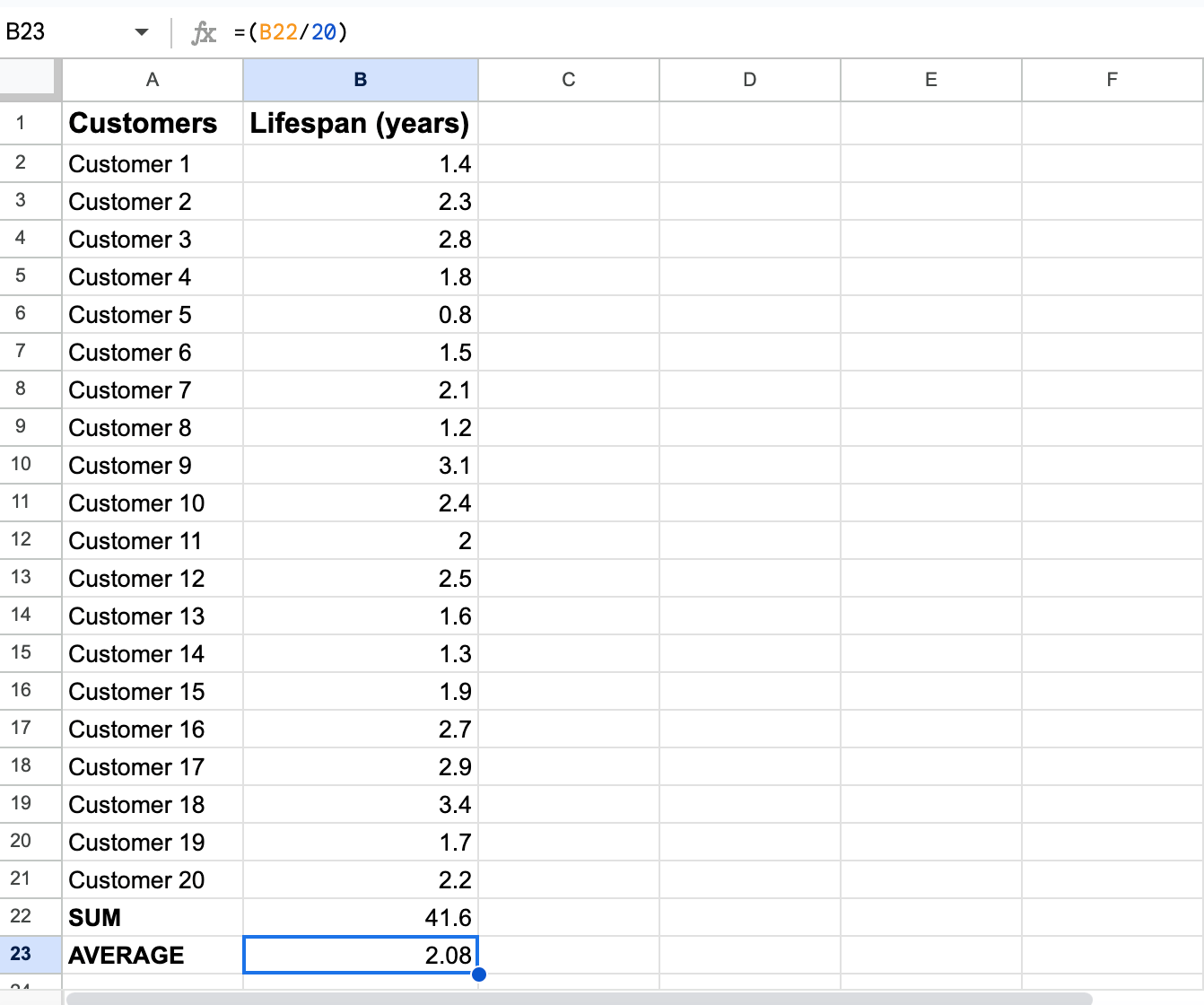

The rule of thumb is that customers whose time since their last purchase was 3x that average interval you just calculated are considered churned, and their lifespan has ended. Take each customer you’ve considered churned and put their lifespans in a spreadsheet (anonymized). From there, you can use the following formula:

(Sum of all customer lifespans / Total number of customers)

Here’s a small example of what this could look like:

With your average lifespan at hand, you can complete the formula. Which, as an example, could look like this:

- Average purchase value = $46.87 ($75,000 / 1600)

- Purchase frequency = 8 (1600 / 200)

- Customer value = $374.96 ($46.87 x 8)

- Customer lifespan = 2.08

- CLV = $779.92 (rounded up)

Phrased as a formula: ($46.87 x 8) x 2.08 = $779.92, or

$374.96 x 2.08 = $779.92

There you have it. However, it’s worth mentioning that this CLV formula uses revenue instead of profit. If you wanted to figure out the CLV based on profit, you’d need to subtract the average customer acquisition cost from your revenue-based CLV.

Predicting lifetime value in ecommerce

Another way of calculating CLV using a predictive model is to look at a customer’s future value. LoyaltyLion uses this model for its customer analytics dashboard (so if you sign up to LoyaltyLion, you won’t need to do this manually).

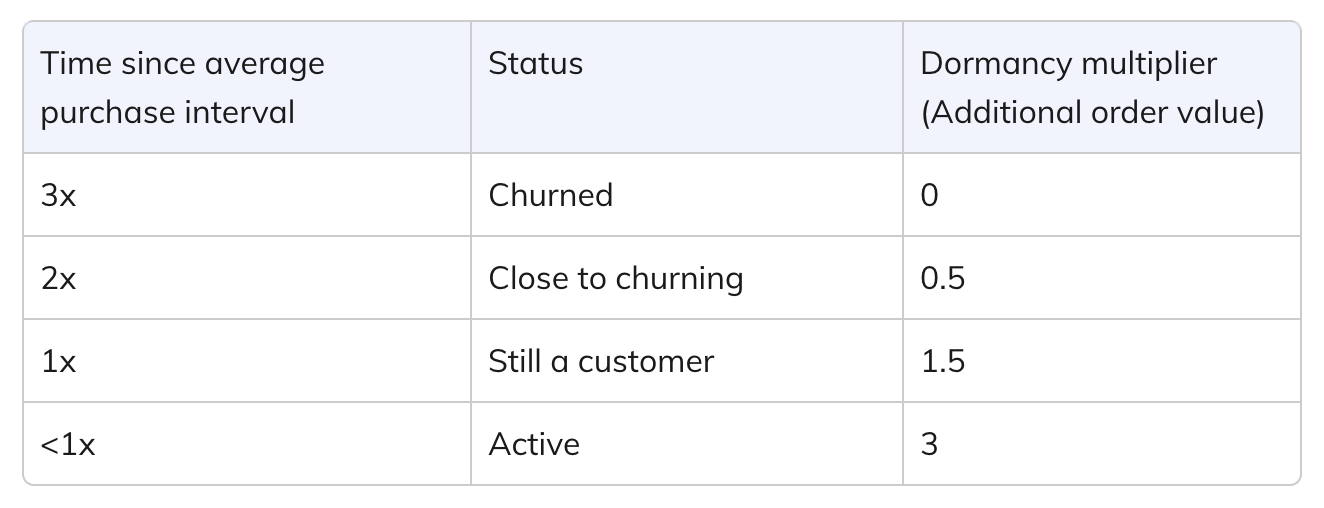

It uses the same 3x purchase interval rule but with a few extra intervals to get more granular. However, the base formula is as follows:

All revenue + (Dormancy multiplier * Average order value)

And here’s a table for figuring out the dormancy multiplier based on time since the average purchase interval:

For examples using figures, check out the LoyaltyLion help article that explains the model in more detail.

What is a “good” CLV?

Ultimately, a “good” CLV is greater than your customer acquisition costs. There’s no real benchmark data for CLV in ecommerce because it varies and depends on factors like AOV, purchase frequency, and CAC.

That being said, we discussed the CLV:CAC ratio further up in this article, and I bring it up again here because an ideal CLV value is at least 3x your CAC.

For example, in the CLV calculations above, the example store has a CLV of $779.92. If the same store’s CAC was $260, the CLV would be almost 3:1. However, if the CAC were $800, the CLV would be considered bad because you’re losing money for each customer you acquire.

How to increase your ecommerce CLV

So, now you know your CLV (or at least how to figure it out later), you have a baseline to work from to improve it. Below are three main tips for helping you bring that CLV up for your ecommerce store.

Learn more about user experience

The harder it is for customers to actually buy products in your store, the less likely they are to do so. User experience is a key factor in getting customers to come back to your store to make a second, third, fourth, etc., purchase.

There are a few UX principles to keep in mind when building and maintaining your store:

- Make sure your website’s information architecture makes sense to your customers. To find out, conduct a tree test.

- Additionally, make sure your product categories also make sense to your customers. Again, if you need help, try card sorting tests.

- Create a knowledge center or help archive it so customers can find answers to common questions.

- Follow UX accessibility guidelines to make your website usable for anyone.

No one likes using a clunky, hard-to-navigate website, so make sure you’ve got all these points down before moving on to anything else.

Use email marketing automation

You probably already use marketing automation to promote events like sales and product launches. However, with your CLV data, you can segment your customers into “high-value,” “mid-value,” and “low-value” customers.

With these segments in place, you can create targeted email campaigns for your mid and low-value customers, encouraging them to make further purchases.

A good tactic to try here is offering low-value customers product bundles based on their first or previous purchase. This method helps increase their average order value and, by extension, their CLV.

Suppose you have a loyalty program in place. In that case, you can also use loyalty-based email integrations to retain high-value customers and encourage reward redemption from mid/low-value customers.

Use loyalty tiers

The final tip is to create a tiered loyalty program. Many brands use a simple, points-based loyalty program where points = discounts. However, using a tiered approach allows you to offer your customers higher-value rewards the more loyal they are to your brand.

Here’s the bonus — the tiered rewards don’t have to mean bigger discounts, which would impact your profit margin. Instead, you can offer experiential rewards such as first dibs on new products, early access to sales, and even VIP passes to in-person events.

To offer a concrete case study of tiered loyalty boosting CLV, look no further than Edgard & Cooper.

Their tiered loyalty program was structured to maximize participation and engagement, and as a result:

- Members who redeem rewards spend 15 times more than non-members;

- These customers also spend 3.8 times more often than non-members and

- Almost 50% of the brand’s revenue can be linked to the program members.

Those first two points showcase how well a tiered loyalty program can help improve CLV.

Other metrics for ecommerce brands

Okay, so you might still be thinking about whether or not CLV is worth your time in measuring. If it’s something you’re still getting ready for (for example, if your store is still relatively new and you need the data for it), there are a few other metrics that are related but easier to work with.

Average Order Value

Your average order value helps you determine how much your customers spend per purchase on average and indicates what initiatives are working well for adding products to customers’ baskets.

Here’s the formula you need:

AOV = Total revenue / Total orders

It’s a super easy one and a metric you can track early on, as you’ll only need more than one purchase from your store.

Repeat Purchase Rates

Your repeat purchase rate represents how often your customers come back to your store. It’s similar to the purchase frequency metric used in the CLV calculation. This metric helps you determine whether your customers are satisfied with your products (high rates mean yes, low rates mean no).

Here’s the formula you need:

RPR = (Number of customers who have made repeat purchases / Total number of customers) x 100

This formula gives you a percentage figure.

Customer Satisfaction

Customer satisfaction (CSAT) helps you determine how your customers actually feel about your brand or products. You usually measure CSAT through surveys after purchases or after a customer support interaction. With this data, you can understand which parts of your business could use improvement.

The formula you’ll need is based on survey responses:

CSAT = (% of Satisfied responses) / (Total responses) x 100

Maintaining a high CSAT score indicates that your customer retention program is on the right track.

Churn Rates

Finally, we touched on churn rates within this guide already, and like CLV, they’re a bit trickier to measure. However, it’s a good idea to try measuring it, as a high churn rate tells you that you’re not retaining customers well, and you’ll inevitably be spending more on customer acquisition.

We have a whole guide for calculating ecommerce churn rates, as again, it’s different from the typical MRR model you’ll see in other guides online.

Measure and optimize your ecommerce CLV with LoyaltyLion

Calculating and monitoring your store’s CLV, as seen from this guide, can take much upfront work.

However, suppose you build a loyalty program with LoyaltyLion. In that case, you get access to a customer dashboard that (among other important data points to track) uses the predictive model for calculating CLV, so you don’t have to do it manually.

On top of that, building your loyalty program through LoyaltyLion allows you to improve your CLV thanks to features that include:

- Tiered loyalty program creation

- Customized rewards

- A built-in referral program

- Integrations with popular tools including Klaviyo, Attentive, Gorgias, Verdn, Gatsby, and more.

Ready to take your CLV to the next level? Check out the LoyaltyLion pricing page to find a plan that suits your business today.