For many ecommerce brands, loyalty programs have become an essential tool for retaining their customers and increasing repeat purchases. But how can you tell if your loyalty program is truly motivating your members? That’s where redemption rates come in.

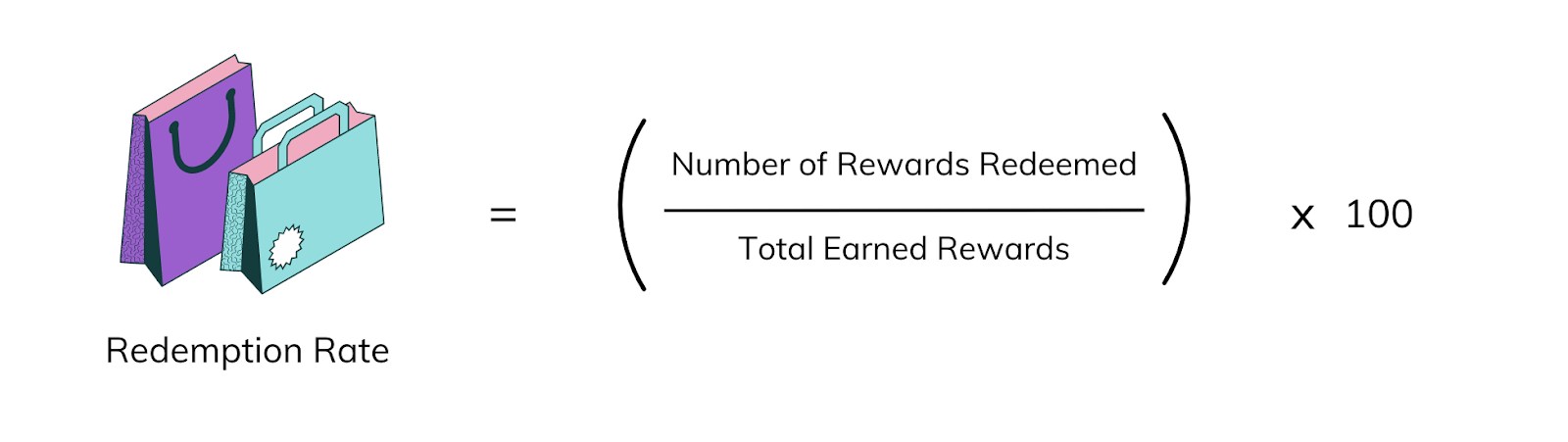

Your loyalty program’s redemption rate represents the percentage of earned rewards that customers actually redeem. It’s calculated by dividing the number of rewards redeemed by the total rewards earned.

Redemption rates are important to measure because they indicate how engaging your rewards really are. For example, if your redemption rate is low, this suggests that either your rewards aren’t appealing or your reward redemption process is overly complicated. Having these insights is important because both of these scenarios need addressing for your loyalty program to be effective.

On the other hand, a high redemption rate indicates that your rewards are perfectly aligned with your audience, and you can rest assured that this element of your loyalty program is performing well.

By the end of this article, you’ll know how to calculate your redemption rate, the reasons it might be lower than expected, and—most importantly—how to improve it.

Why you need to track your redemption rates

As we’ve just mentioned, redemption rates are a large indicator as to whether the rewards in your loyalty program truly resonate with your customers. High redemption rates signal strong customer engagement and satisfaction.

Redemption rates also help to measure the success of your loyalty program in driving repeat purchases. Without the right rewards to inspire your customers, it’s unlikely that they’ll be motivated to come back and make future purchases.

Finally, it’s important to track your redemption rates to help with the financial planning of your loyalty program. Understanding expected redemption rates means that you can accurately allocate a budget for your rewards without overextending resources.

How to calculate loyalty program redemption rates (with examples)

Calculating the redemption rate of your loyalty program is really straightforward. The basic formula is:

Redemption rate = (Number of rewards redeemed / Total earned rewards) x 100

For example, if your loyalty program issued 100,000 points in a month and 25,000 of those points were redeemed, the redemption rate would be:

Redemption Rate = (25,000 / 100,000) x 100 = 25%

To illustrate this further, let’s say a beauty brand offers a free product to every loyalty program member when they hit their tenth purchase. Over the course of a year, 500 free products have been earned but only 250 of those have been redeemed. The redemption rate in this scenario would be:

Redemption Rate = (250 / 500) x 100 = 50%

Redemption rates by type of loyalty program

As we’ve just covered in the previous example, redemption isn’t solely confined to points, and it’s important to acknowledge how redemption rates can vary depending on which type of loyalty program you have.

For example, with a tiered loyalty program, where customers unlock better rewards the more they spend or engage with a brand, redemption rates often climb as members move up the tiers. This is because higher tiers offer more valuable rewards (increased discounts, exclusive free products, invites to events), making them more enticing to redeem.

With a value-based loyalty program, where rewards often include charitable donations or sustainable actions like having a tree planted on a customer’s behalf, the redemption rate is an important indicator as to whether your chosen charity and sustainable incentives resonate with your members. If your customers are earning rewards but aren’t inspired enough to redeem them, then something is off.

No matter how your loyalty program is structured, regularly tracking redemption rates is essential to verify that your rewards remain relevant and appealing to your customers.

Average loyalty program redemption rates

While a “magic number” for an ideal redemption rate doesn’t exist, benchmarks can provide a valuable starting point to assess the health of your loyalty program.

Recent global data shows that the redemption rate of all loyalty program rewards (including points, cashback, and other rewards) totaled 49.8% in 2023. But what success looks like for your brand will be heavily influenced by which industry you’re operating in.

For example, retail loyalty programs tend to have higher redemption rates because they offer tangible rewards, such as discounts or free products, which can drive higher engagement. Another industry that sees very healthy redemption rates is travel and hospitality, likely due to the highly desirable rewards such as free stays or flights, which motivate customers to accumulate and use their points.

On the other hand, loyalty programs in the financial services sector, such as those offered by banks or credit card companies, typically see lower redemption rates compared to other industries. While customers can easily earn points through spending, the redemption process can be complex, involving multiple steps and limited reward options.

Reasons for a low redemption rate

If you’ve calculated your redemption rate and feel disappointed by the result, don’t start panicking just yet. The first step is to figure out where things are going wrong, and it’s likely that one of the following obstacles is the culprit:

- Inadequate incentives. Quite simply, if the rewards are not appealing, your customers won’t bother redeeming them. It’s important to consider what motivates your customers and create a reward structure that’s unique to your brand.

- A complex redemption process. A cumbersome redemption process with unclear messaging can deter your customers from using their points and rewards. Think about any barriers to reward redemption you could improve or remove altogether.

- Low purchase frequency. Another reason you might be seeing a low redemption rate is that your customers aren’t purchasing often enough to build up their points balance and earn rewards. We’ll cover some ways to address this in the next section.

How to maximize your redemption rate

Improving your redemption rate is key to ensuring your loyalty program captivates customers and drives more repeat purchases. Here’s how the best loyalty programs maximize redemption rates:

- Offer appealing and valuable rewards

Make sure that your rewards are desirable and provide genuine value to your customers. For example, you could offer beauty fanatics free product rewards or give dog lovers the opportunity to donate food to a dog shelter, as Edgard & Cooper does.

If you aren’t sure where to start, conduct surveys or use customer data to determine what types of rewards your customers value the most, then tailor your rewards to meet these preferences.

- Diversify your rewards

Include multiple reward options to appeal to as many preferences as possible. Consider including discounts on future purchases, free products, free shipping, exclusive experiences, and charitable donations to appeal to a broader audience.

- Simplify the redemption process

A straightforward redemption process encourages more customers to use their rewards. Minimize the number of steps required to redeem rewards and ensure that the whole process is intuitive and user-friendly.

- Communicate effectively

Provide clear and concise instructions on how to redeem points and rewards, using visuals and guides to help customers navigate the process if necessary.

You should also send regular reminders via email, SMS, or app notifications about available rewards and how close customers are to earning them, letting your members know as soon as they’ve unlocked a new reward. Setting up automated workflows for these reminders is simple with our Klaviyo integration.

- Lower your reward thresholds

Make sure that the points required to unlock a reward are attainable. This is especially relevant if you have a low purchase frequency.

If your customers aren’t purchasing often enough to unlock rewards (for example, if you sell large ticket items that people only buy occasionally), consider reducing the reward thresholds so that members can reach them within a reasonable timeframe. You could also introduce smaller rewards for fewer points to keep customers engaged and motivated while they save for larger rewards.

- Create more earning opportunities

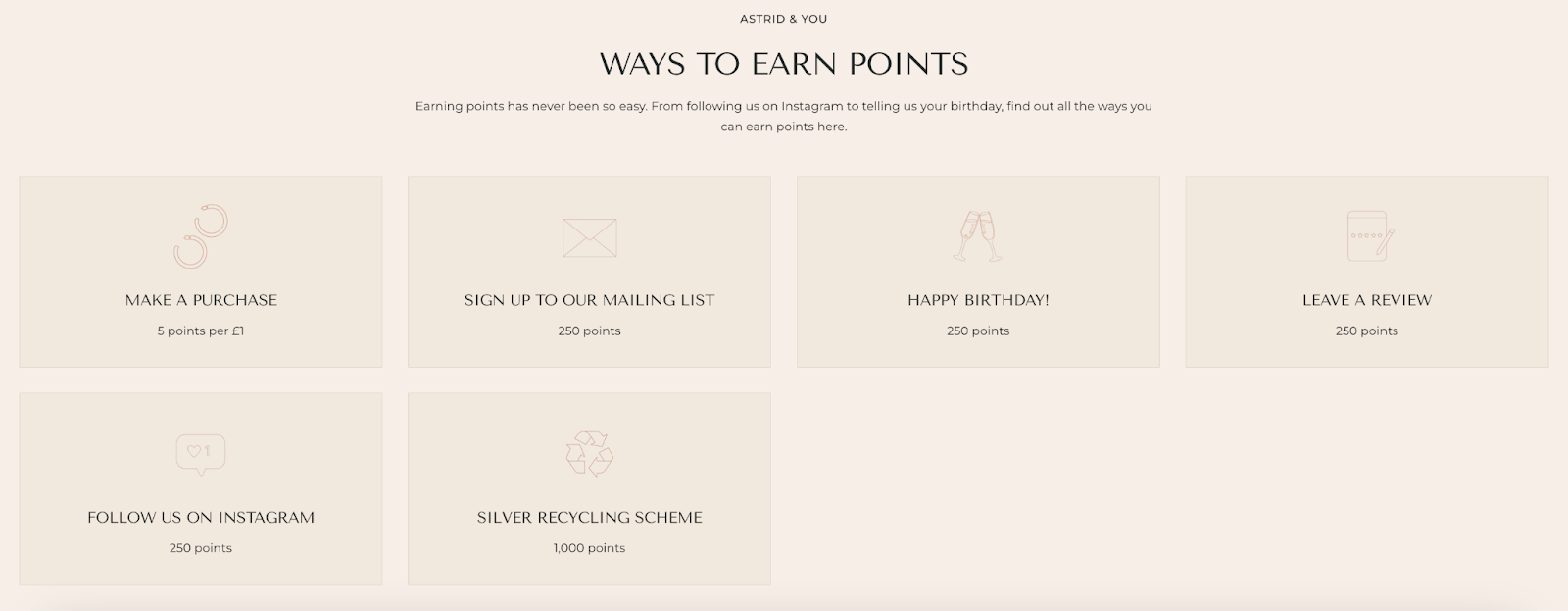

Increase the number of ways customers can earn points so that they can reach a reward faster. Allow loyalty program members to earn points through various actions such as purchases, social media engagement, referrals, and reviews.

We love how Astrid & Miyu incentivize customers to follow their brand on Instagram and sign up for their newsletter – creating even more opportunities for connection – by offering loyalty points for these actions. This not only helps customers earn rewards faster but also strengthens the relationship between the brand and its customers by creating more touchpoints.

- Consistently track and analyze your performance

You can’t manage what you can’t measure. Make a habit of regularly calculating your redemption rates and noting any patterns or trends. Are there certain times of the year when redemption rates spike? Are there specific rewards that are more popular? Understanding these trends can help you optimize your loyalty program.

How redemption rates compare to other loyalty program metrics

Redemption rates are an important metric for evaluating the effectiveness of a loyalty program, but they’re just one piece of the puzzle. To get a clear understanding of your loyalty program’s overall performance, it’s essential to consider redemption rates alongside the following loyalty metrics and KPIs.

Customer lifetime value (CLV)

Customer lifetime value (CLV) helps you understand how much a customer is worth across their lifetime of shopping with you. A loyalty program that performs well should boost CLV by getting customers to spend more over a prolonged period of time, and it’s likely that your customers with the highest redemption rate will also have a high CLV.

Customer retention rate (CRR)

Customer retention rate measures the percentage of customers who continue to purchase from your brand over a specific period. While a high redemption rate indicates that customers are actively engaging with your loyalty program, a high retention rate shows that they’re also staying loyal to your brand. Together, these metrics can paint a picture of long-term customer loyalty and satisfaction.

Average order value (AOV)

Average order value (AOV) reflects the average customer spend per order and helps identify whether or not your loyalty program members are increasing their basket sizes. High redemption rates often correlate with increased AOV, as effective loyalty programs incentivize customers to spend more to earn and redeem rewards.

Engagement rate

Engagement rate measures how actively customers interact with your loyalty program, including actions like earning points, participating in promotions, and redeeming rewards. While the redemption rate specifically tracks the redemption of rewards, the engagement rate provides a broader view of customer involvement in your loyalty program.

Net promoter score (NPS)

Net Promoter Score (NPS) measures overall customer satisfaction and willingness to promote your brand. A high redemption rate can positively impact your NPS, as satisfied customers who frequently redeem rewards are more likely to become brand advocates.

Final thoughts

Understanding and optimizing your loyalty program’s redemption rates is an important step toward increasing customer engagement and driving more repeat purchases. By using the strategies outlined above to improve your redemption rate, you can create an engaging loyalty experience that motivates your customers to shop with you time and time again.

For more expert insights to elevate your loyalty game, check out our on-demand Loyalty Connect conference.