To calculate the return on investment (ROI) of your loyalty program, you simply need to subtract the net profit of your loyalty program from its total cost and multiply the result by 100.

Here’s the formula:

Net profit / Total cost * 100

Easy enough. The hard bit is accurately calculating those numbers. Here’s how you can do it — with plenty of worked examples.

Calculator your potential loyalty program ROINo need to manually calculate your ROI in a big ugly spreadsheet: you can estimate your loyalty program ROI using our free forecasting tool. Tell us your monthly order volume, average order value, purchases per customer per year, and total lifetime purchases, and we’ll estimate the kind of revenue uplift you can expect. |

How to calculate your loyalty program ROI

First, we start to figure out our net profit by calculating incremental revenue…

The “incremental” part is important here. We’re trying to figure out how much additional revenue we made from our loyalty program members that we wouldn’t have made if they hadn’t signed up to the loyalty program.

If we simply add up revenue from loyalty program customers, our numbers will be misleadingly rosy.

The first thing to do is figure out how much revenue we make per customer (on average) both before and after they signed up for the loyalty program.

To do that, we first need to divide our total revenue by the number of customers over a given period of time. This gives our “average revenue per customer”.

When we have that figure, we can work out how many customers enrolled on the loyalty program and multiply that number by the average customer revenue. That gives us our pre-loyalty program benchmark.

Then we can segment our sales data by loyalty program members, do the same calculation for customers after they enrolled on the program, and calculate the difference.

Here’s an example.

Baseline metrics (before program):

- average revenue per customer (pre-enrollment): $150

- number of enrolled members: 2,000

- total revenue from loyalty program members (pre-enrollment): 150×2,000=$300,000

Post-enrollment metrics (after program):

- average revenue per customer (post-enrollment): $200

- total revenue (post-enrollment): 200×2,000=$400,000

Incremental revenue:

- incremental revenue: $400,000−$300,000=$100,000

In that example, our incremental revenue is $100,000, because our average revenue per loyalty program member increased by $50 after they enrolled — and 2,000 people enrolled in total.

To calculate revenue increases, you need an average “customer lifespan” — and that will depend on your business model

You’ll have noted we said “over a given period of time” in the previous section. The length of that time period depends on your business model.

Some products are purchased infrequently. For example, if you sell refrigerators, even your most loyal customers wouldn’t buy from you more than once every 5 years or so. (If they needed to, they wouldn’t be all that loyal.)

So if you only looked at revenue per customer over the last quarter, you wouldn’t get a full reflection of how much revenue you generate from a customer.

But if you sell groceries, you might expect multiple purchases within the same month, and you might safely assume that a customer who hasn’t bought from you in over a year is no longer an active customer. In this case, you’d want to use a much shorter timescale — maybe quarterly, or even monthly.

You know your customers — you’ll probably have a rough sense of what this timescale should be. But if you want to be sure, you can calculate the purchase frequency of your most loyal customers. That will give you a sense of the highest frequency you could realistically expect.

…With incremental revenue in place, it’s time to calculate your costs…

This calculation should include both one-off setup costs and ongoing expenses.

Be sure to include:

- Software and platforms

- The actual marginal costs of offering rewards (such as reduced profit on discounted products, the cost of delivering experiential rewards for tiered loyalty programs, or the expense of shipping freebies)

- HR and training (if applicable)

- Marketing the loyalty program

When you have this figure, you can subtract it from your incremental revenue to get your net profit.

…And then put it all together to calculate your ROI

Divide your net profit by your total costs, and then multiply the result by 100 to get a percentage. This is the % of profit made on your loyalty program. To make it a proper ROI calculation (with 100% as breaking even) add 100 percentage points

Here’s an example of how it all fits together.

Net profit calculation:

- Incremental revenue = $100,000 (loyalty program revenue = $400,000 – benchmark revenue of $300,000)

- Total costs = $80,000

- Net profit = $20,000 (incremental revenue – costs)

ROI calculation

- Net profit = $20,000

- Total costs = $80,000

- ROI = 125% (20,000/80,000*100, plus 100 percentage points)

In our example, ROI is 125% — or 25% profit.

Remember that your ROI calculations will be influenced by the kind of loyalty program you have

Different kinds of loyalty programs work in different ways, and this gives them different revenue sources and costs.

If you run a paid loyalty program, for example, your incremental revenue will be the subscriptions you receive from customers each month.

Or if you run a tiered loyalty program that offers exclusive events for the highest spenders, the cost of hosting that event will be a cost to consider.

For a typical points-based loyalty program, you need to consider the profit you miss out on by discounting products.

If your ROI is low, carefully diagnose why

If your ROI isn’t as shiny as you’d like it to be, don’t panic and abandon your loyalty program. There can be lots of fixable reasons you’re not seeing the success you hoped for.

For one, loyalty programs often take time to generate momentum, and many of the costs are front-loaded. So in the first year or so the costs look disproportionately high while the incremental revenue looks disproportionately low.

If yours is a long-running loyalty program that’s still providing disappointing returns, you need to think carefully about why this might be.

If the average customer revenue for loyalty program members is strong, the issue is likely a lack of enrollment. What can you do to better promote the program?

Or if there’s a high enrollment rate, but revenue doesn’t increase as you’d like, reconsider the rewards you’re offering.

Think too about how customers use your loyalty program: are they actually engaging after signing up? Are they redeeming their points?

These things aren’t always easy to diagnose. But there are tried-and-true metrics you can track to find out more.

Remember that ROI isn’t the only metric to keep an eye on

ROI might be the ultimate metric for your loyalty program — in the end, the many benefits of running a loyalty program should ladder up to “more profit from existing customers” — but it’s not the only thing to look at. ROI can take time, and a less-than-ideal return in the early stages doesn’t tell you why you’re not seeing the return you want.

Other metrics can add context and help you make the right decisions about your loyalty program, which in turn will lead to a higher ROI.

1. Point redemption

This metric examines how customers utilize accrued loyalty points across different segments, tiers, and timeframes. Analyzing variations in redemption patterns across demographics or seasons offers insights into program effectiveness.

Understanding point redemption patterns helps you to optimize rewards, ensuring they resonate with customers, ultimately boosting program engagement and fostering stronger brand loyalty. For example, a brand could notice that younger customers tended to redeem points for experiential rewards like event tickets, prompting them to introduce more of such rewards, which leads to significantly increased engagement among that demographic.

2. Repeat customer rate

Calculating the percentage of customers returning for subsequent purchases provides a straightforward measure of loyalty program success. It’s a simple ratio derived from dividing the number of repeat customers by the total number of customers. A higher repeat customer rate signifies improved customer retention, which directly contributes to increased revenue and sustainable business growth.

3. Purchase frequency

Tracking how often loyalty program members make purchases within a specific time frame helps gauge the impact of the program on their buying behavior. It’s an easy calculation focusing on the frequency of transactions. Increased purchase frequency among loyalty members translates to higher customer lifetime value, leading to enhanced revenue generation for the business.

An example of this would be if a subscription-based service noticed a direct correlation between offering exclusive rewards and an uptick in the number of monthly purchases made by loyal members.

4. Average time between purchases

This metric measures the average duration between successive purchases by the same customer. It’s a simple time-based calculation that indicates customer retention. Decreasing the average time between purchases indicates improved customer engagement and a more consistent revenue stream over time.

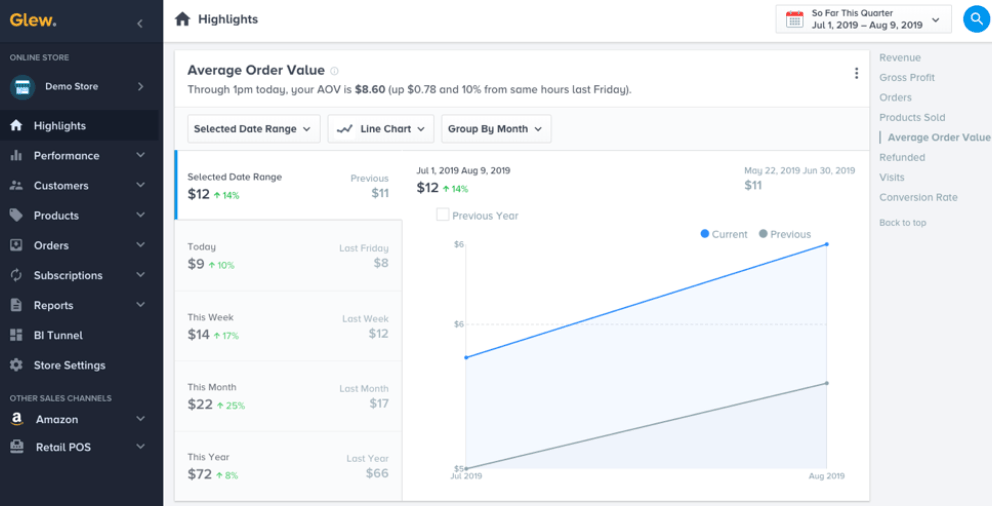

5. Average order value

Analyzing the average order value among loyalty members validates whether the program is successfully encouraging increased spending per transaction. Higher average order values among loyalty program members directly impact your bottom line by increasing overall sales revenue and profitability.

6. Lifetime value

This metric estimates the total revenue generated by a customer throughout their entire association with the business. It involves comparing the lifetime value of loyal versus non-loyal customers. Maximizing customer lifetime value through loyalty programs ensures a more sustainable and profitable customer base for the business in the long term.

Imagine, for instance, that you increased the lifetime value of loyal customers by 25% by refining their loyalty tiers and introducing targeted offers for high-value customers.

7. Revenue, profit & margin

Assessing the revenue, profit, and margin from loyalty program members versus non-loyalty program members involves integrating loyalty program data with sales and cost information. Evaluating revenue, profit, and margins from loyalty program members against non-loyalty program members provides a clear understanding of the program’s direct impact on the company’s financial health and profitability.

How to track the ROI of loyalty programs

Unlocking the ROI of loyalty programs hinges on strategic reporting and analysis. While it’s essential to monitor fundamental metrics like repeat customer rate, average order value, purchase frequency, and lifetime value across your entire business, the real insight into the performance of your loyalty program emerges through segmentation and comprehensive reporting.

Additional tips

- Visualization: Use charts and graphs for enhanced data storytelling and improved stakeholder conversations

- Actionable insights: Turn findings into actionable strategies for program improvement.

- Listen to your audience: Continuously gather feedback through surveys, reviews, and social media to keep your program relevant and aligned with customer expectations.

By implementing these report methods and tips, you can gain valuable insights into the ROI of your loyalty program, optimize rewards and tiers, and ultimately drive customer engagement and growth. Remember, data is only as valuable as the actions you take based on it. So, leverage these reports to unlock your loyalty program ROI.

How to optimize your loyalty program ROI

Effective loyalty programs can deliver significant business value, promoting customer engagement and driving revenue growth. However, achieving optimal return on investment (ROI) requires strategic optimization beyond simply implementing a program. Here are five data-driven strategies to maximize the effectiveness of your loyalty initiative:

1. Targeted Segmentation: Moving beyond a one-size-fits-all approach, segment your members based on relevant criteria, such as purchase history, engagement level, and loyalty tier. This enables tailored reward structures, personalized offers, and targeted communication, enhancing engagement and maximizing value for specific customer segments.

2. Reward reimagination: Go beyond traditional points and discounts. Consider offering exclusive experiences, early access to new products, personalized recommendations, or charitable donations aligned with member preferences. Such non-traditional rewards can foster deeper emotional connections and enhance perceived program value.

3. Data-driven personalization: Leverage customer data and analytics to deliver personalized communication and offers. Recommend relevant products based on purchase history, send targeted emails for birthdays or special occasions, and tailor reward options based on individual preferences. This personalized approach promotes stronger customer connection and drives engagement.

4. Metrics-focused evaluation: Regularly track key performance indicators (KPIs) such as repeat purchase rate, average order value, and customer lifetime value. Analyze these metrics to identify areas for improvement and refine your program strategy accordingly. Data-driven decision-making ensures continuous optimization and maximizes program ROI.

5. Continuous Feedback Loop: Actively solicit member feedback through surveys, polls, and social media interactions. Understand their needs, concerns, and suggestions. This valuable input allows you to adapt your program offerings and rewards, ensuring continued relevance and alignment with customer expectations.

By implementing these strategies, you can transform your loyalty program into a powerful and successful tool for customer retention, engagement, and ultimately, increased ROI. Remember, success lies in data-driven insights, personalized experiences, and ongoing program refinement based on member feedback.

Wondering how to predict the ROI of your loyalty program? Our loyalty program ROI calculator can help!