In this guest post, ViaBill shares the latest insights on how shoppers want to pay today and why finding an online payment solution that works for your customers can improve customer loyalty and retention.

In a world with ever-increasing customer demands, it is up to merchants to provide easy-to-use and seamless solutions. Millennials specifically, prefer not to waste time and effort visiting stores in person, with the added burden of carrying all of their newly purchased items afterwards.

But, with an overly saturated market, how do customers prioritise their purchases? And how do they manage to pay for what they want without jeopardizing their credit score? There is one answer: Customer Financing.

The rise of customer financing

Many US consumers, millennials specifically, have a love-hate relationship with credit. 83% of the people who took the ViaBill survey, said that they would rather not buy anything than carry credit card debt.

According to data from the Federal Deposit Insurance Corp, personal loans issued by banks, excluding credit cards, auto and home equity loans, hit a record $807 billion in 2017. Exactly why customer financing is so important.

But what is customer financing?

Customer financing allows customers to buy now and pay later by enrolling in a payment plan to pay for goods or services online in instalments.

At the checkout, they will have the chance to continue with a third party to complete the payment. Similar to a credit card, the merchant receives full payment upfront. In addition, the customer receives the purchased item right away but pays the money off over time.

With more shoppers looking to stretch their budget, customer financing is becoming an increasingly popular method of payment. The need to buy now and pay later is there and shoppers are using it more every day.

According to Forbes Magazine, merchants in nine different retail categories saw more than 160 million point-of-sale loan applications made in 2016.

Current trends in customer financing

Today, people are exposed to three different customer financing solutions.

A private label credit card

A private label credit card is a store-branded credit card that is intended for use at a specific store. It’s a type of credit plan managed by a bank or commercial finance company for either retail or wholesale manufacturers, such as department and speciality stores.

Instalments

Instalment loans include any type of loan that is repaid with regularly scheduled payments. Each payment on an instalment debt includes the repayment of a portion of the principal amount borrowed and also the payment of interest on the debt.

Line of Credit

A line of credit is a preset amount of money that a bank or credit union has agreed to lend you. You can draw from the line of credit when you need it, up to the maximum preset amount. Some loan vendors may require you to pay interest on the amount you borrow.

How ecommerce merchants benefit from customer finance solutions

High buying frequency percentage

According to a research study conducted in 2017, shoppers are more likely to have a high buying frequency percentage when they are using customer financing rather than traditional payment methods. According to the study, they feel more at ease shopping with an extended credit line and are more loyal toward that specific payment method.

Increased basket size

Payment options with extended credit line and instalments have a higher basket size. They cut down the load of the total cost meaning that shoppers feel more comfortable buying more with partial payments paid over time.

For example, +27% of all baskets paid with the ViaBill payment solution are larger than the average basket size. Competitor X has a +19% rate, while wallet purchases have a -11% rate. Both ViaBill and Competitor X offer customer financing solutions and have significantly larger basket sizes on average.

391 billion reasons to choose customer financing

A high buying frequency and increased average basket sizes are what makes customer financing an attractive solution to online merchants. In fact, Filene Research Institute estimated the annual size of the POS financing market at $391 billion, which is approximately 3.5% of annual consumer spending, with health care, electronics, and home goods as the leading categories.

Provides a good customer experience

73% of buyers point to customer experience as an important factor in purchasing decisions. A customer finance solution will show your customers how your customer experience is different from your competitions’ and keeps you front of mind. By having something worthwhile to engage with, they’ll be sure to return to purchase from you.

How can you implement a customer finance solution?

Make it an add-on and not a change

Increase your transaction numbers by seamlessly integrating a customer finance solution into your customers’ checkout flow. This means your customers will never have to leave your site to make a payment.

Make it from the shopper’s point of view

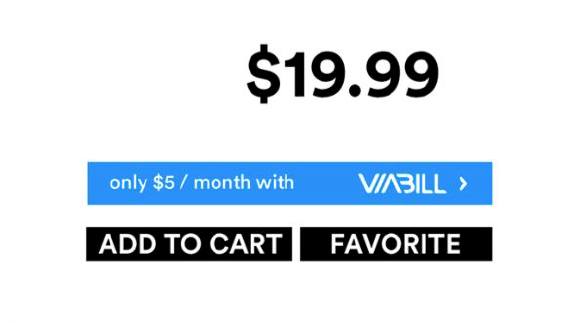

Once the shopper enters your product description page, make sure your customer finance costing appears right under the original price. Then, when a customer clicks it, make sure you clearly inform the shopper of what your solution entails. This will create a relationship of trust right from the start.

Reducing abandoned carts

Online shopping carts are primarily abandoned because shoppers don’t have the money to pay upfront.

Since a customer finance solution can be integrated at the checkout, you can increase your conversion rate and the number of transactions with immediate effect. It will also snoozers into buyers by increasing their purchasing power.

ViaBill Bio

ViaBill is a customer financing solution that changes the way people shop online. They offer a payment solution that empowers shoppers to have the freedom of choice and to get what they deserve. They provide their shoppers with a simple, transparent and understandable payment method and give them the opportunity to buy now and pay over four equal monthly instalments with zero interest – while the merchant gets paid upfront and in full.

Today, ViaBill works with over 5,000 merchants around the world and is mainly focusing on increasing growth in the US market. It has succeeded in boosting businesses in many ways.

Want to get started with Viabill?

Use the coupon code LoyaltyLion for one month of free transactions and no setup fee (usually $599) on Viabill – offer expires 8/19. Just click “GET STARTED” on www.viabill.com and enter your coupon there.